Date: Sep 21st 2023

Learn how to protect your product listings’ integrity by preventing unauthorized sellers from piggybacking off your success.

Date: Sep 21st 2023

Learn how to protect your product listings’ integrity by preventing unauthorized sellers from piggybacking off your success.

Date: Aug 30th 2023

It's been just over a month, was Prime Day a success? In this blog article, we will examine how some of our clients fared.

Date: Jun 20th 2023

Learn what different codes to identify products mean, how to get them and which you need for products you sell on Amazon.

Date: Apr 11th 2023

The silver bullets for Product Detail Page SEO optimization in 2023 - both DTC websites and Amazon.

Date: Apr 4th 2023

Learn what an optimal agency partnership looks like, and why hiring an agency makes fiscal and strategic sense for your business.

Date: Mar 28th 2023

Amazon's new capacity management system can resolve uncertainty about costs and inventory limits for smart sellers.

Date: Jan 12th 2023

Our research reveals why shoppers buy via Amazon vs a brand’s website, and how they use Amazon to discover unknown brands.

Date: Dec 19th 2022

Emplicit's predictions on what 2023 has in store for Amazon.com so you can stay ahead of the curve and take early advantage of new

Date: Dec 14th 2022

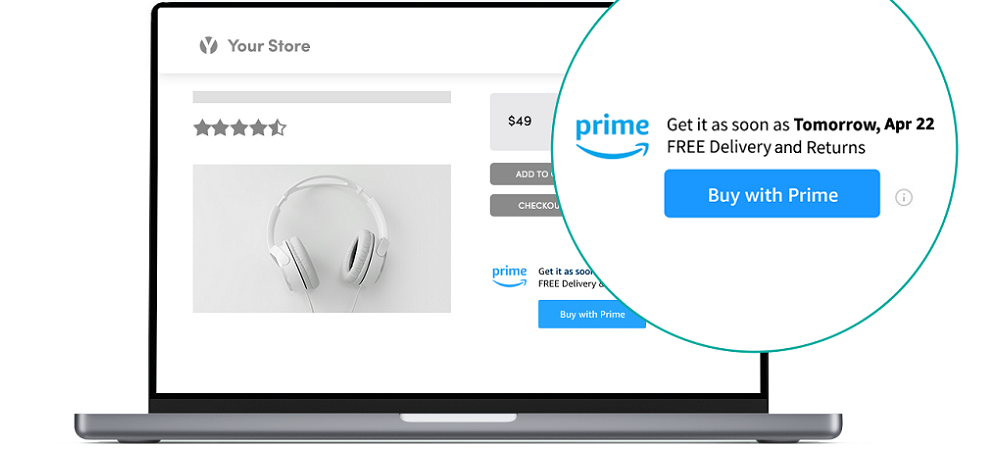

Amazon's Buy With Prime gives you all the benefits of FBA fulfillment, but Shopify isn't too happy about it.

Date: Nov 9th 2022

Picking an Amazon agency is an important decision for your business, so it shouldn't be made lightly, so we've created a quick guide to help.