As an eCommerce merchant, you must receive product payments on time. Without steady payment terms, your company’s success is on the line. That’s why it’s imperative to know your options for accepting online credit card payments on your website using Amazon Pay and how Amazon Pay payouts work.

The truth is that Amazon Pay payouts can confuse online sellers, especially when the retail giant delays payouts or pays your company the incorrect amount. And although Amazon makes mistakes, some fault often lies on merchants that aren’t familiar with Amazon Pay’s unique payout structure.

This article will explain Amazon Pay payouts for eCommerce sellers or those looking to expand their existing retail business online. We’ll describe Amazon Pay and Amazon Pay payouts for those who want to know how to benefit from the payment processing service. Let’s start!

What’s The Difference Between Amazon Merchants & Amazon Pay Sellers?

Most Amazon merchants sell directly on Amazon.com and any international versions of the online marketplace. But what if you want to sell on your own platform but leverage the customer information

Amazon already collects about millions of buyers?

Well, in that case, Amazon Pay might be the perfect eCommerce solution for you. Amazon Pay is a service that allows customers to pay on your eCommerce website with their Amazon login credentials.

Merchants using Amazon Pay must also have an Amazon Seller account and use the Amazon checkout process on their website.

When a customer orders from your shop, your site directs them to the Amazon.com checkout page, where they can log in and complete the purchase.

Amazon Pay is available in all countries that Amazon operates. At the same time, Amazon Pay for Merchants is currently only available in a few locations, including the United States, the United Kingdom, and much of Europe.

There are a few reasons why using Amazon Pay could be advantageous to your eCommerce business.

Let’s take a look at some of the benefits:

- Amazon is a known and trusted brand with a large customer base.

- Amazon Pay accepts payments from over 200 countries.

- Amazon Pay for Merchants is only available in the U.S., UK, Germany, Austria, and Japan.

- Amazon checkout is streamlined and familiar to Amazon customers.

- Amazon does not charge any setup or maintenance fees for using Amazon Pay.

- Those are some excellent reasons to join Amazon Pay. But, are there any cons to know? Let’s discuss why Amazon Pay might not be right for your business.

What Are The Disadvantages Of Using Amazon Pay?

There are a few potential disadvantages of using Amazon Pay to note.

Yes, it’s unfortunate, but there are several reasons why you might consider other options.

- You cannot use Amazon Pay to accept in-person payments for your retail business. Instead, customers must complete the Amazon checkout process.

- If Amazon experiences downtime, your eCommerce website will not process payments.

- Since Amazon Pay is a payment method and not a processor, you are responsible for chargebacks and refunds.

- Newer accounts commonly notice Amazon Pay payout delays because of the account reserve policy.

Now that you know the basics of Amazon Pay, let’s discuss how Amazon Pay payouts work and why they can be a challenge for eCommerce merchants.

What Should Sellers Know About Amazon Payouts?

Amazon Pay is an eCommerce payment processor. Buyers can pay for items on third-party eCommerce websites using the information stored in their Amazon accounts.

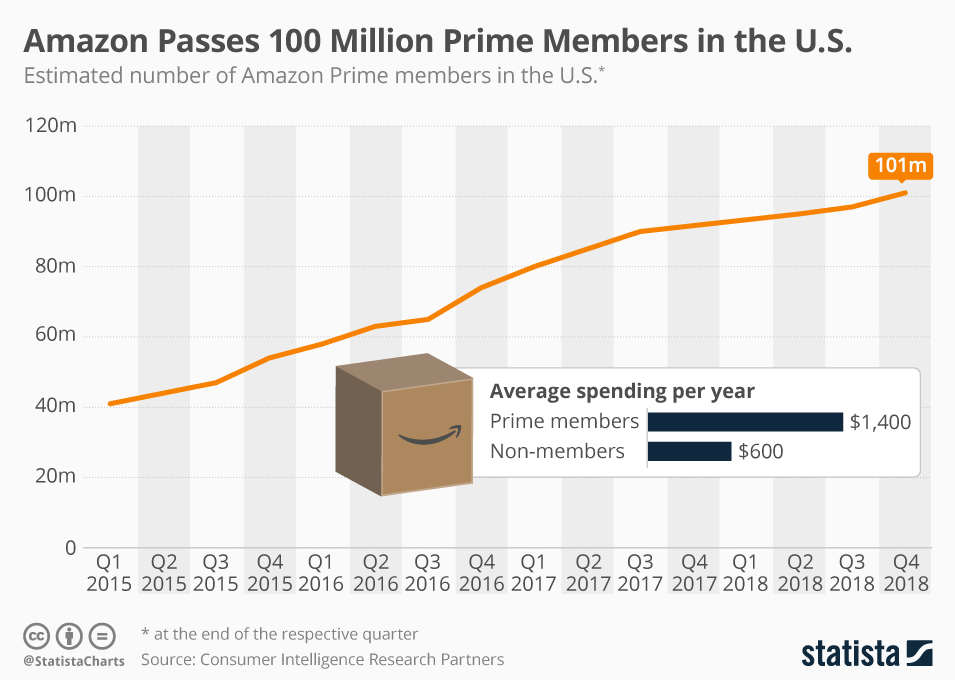

As Amazon Prime has over 200 million members, it’s likely that your customers already have their payment details saved on Amazon.com.

Streamlining your brand’s checkout process could lead to an increase in conversions. And if you want to reduce abandoned carts on your site, Amazon Payouts can help.

Instead of requiring customers to enter their financial details into your website, they can use card information directly tied to their Amazon account.

Doing this saves time and can stop customers from leaving your eCommerce site after adding an item to their cart.

With no fees for setup, maintenance, or cancellation, it’s easy to get started, especially if you’re already set up with an Amazon Seller account.

Although the service is easy to use, beginning sellers often wonder how Amazon Pay payouts work.

Fortunately, it’s not too difficult to understand Amazon Pay payouts once you understand terms like settlement dates and processing reserves. Let’s break down the basics of Amazon Pay payouts.

Here’s How Amazon Pay Payouts Work For Amazon Pay Merchants

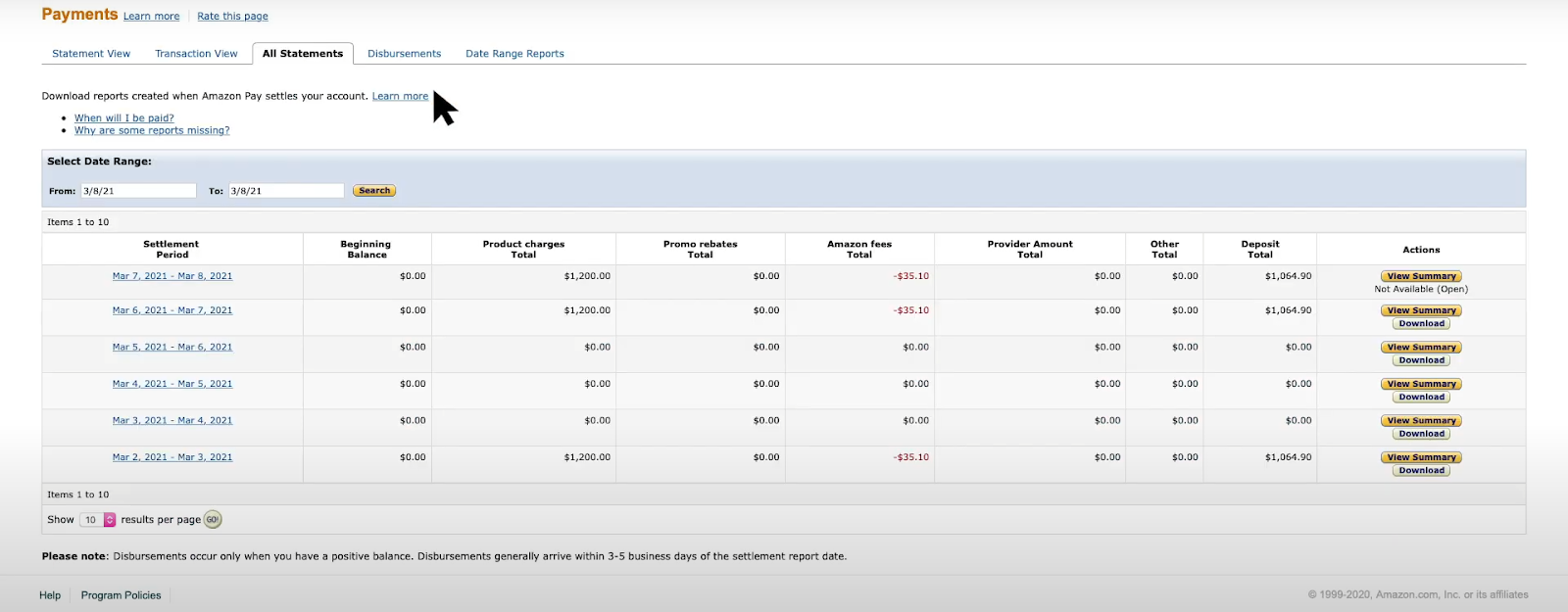

Getting paid through Amazon Pay is fairly simple, assuming no surprise challenges. Amazon Pay deposits funds into your Amazon Pay account after you capture payment.

The funds will be automatically disbursed to your bank account on the next scheduled settlement date, assuming no holds are placed on the disbursement.

Funds usually take two or three days to clear after being deposited into your Amazon Pay account, but this varies depending on your bank.

It’s these clearing days and settlement periods that make Amazon Pay payouts a bit difficult to track. Some banks will take longer, while others can clear your funds quickly.

Disbursements follow the Amazon Pay Reserve Policy, a one-time hold placed on disbursements when you add Amazon Pay as a payment method on your website.

But before understanding the reserve policy and why Amazon places it on Amazon Pay merchants, let’s discuss how payments normally work and what sometimes goes wrong.

How Often Does Amazon Pay Marketplace Sellers

Amazon Pay payouts follow a daily disbursement schedule, but it can take up to two weeks for Amazon Pay to process and send payments.

Amazon Pay payouts arrive in your bank account on specific settlement dates, but there are requirements before receiving payment.

Before a settlement can occur, sellers must review their accounts to see if they have a positive or zero balance. If so, then no Amazon Pay payouts will occur until a seller resolves these issues.

Fees, customer refunds, and reserves, if any, can affect your balance. Therefore, you may not receive the entire amount you sell your products for each month since Amazon charges selling fees and requires an account reserve fund.

Entering valid information in Amazon Pay’s Seller Central for your U.S.-based bank checking account is also required to receive payouts.

Remember that Amazon may also withhold Amazon Pay payouts if they need to investigate a chargeback or other issue with a customer purchase.

Thus, on average, you’ll receive ACH transfers from Amazon around the third to the fifth day of the month, assuming there are no holds on disbursements.

However, that’s a big assumption for some Amazon Pay sellers since newer merchants often note payment delays. Let’s discuss common problems with Amazon Pay.

Understanding Unavailable Balances & Account Level Reserves

Amazon Pay’s Reserve Policy can impact your payouts and daily sales. That’s why some eCommerce businesses go with other alternatives like PayPal or Stripe.

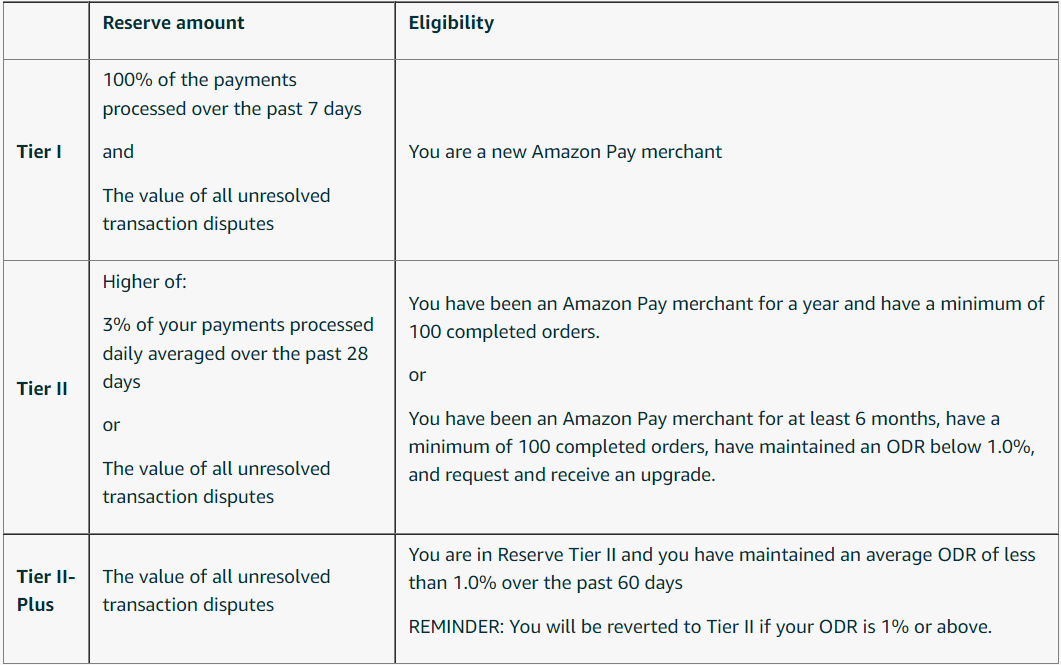

Amazon Pay payouts follow a tiered structure. Three Amazon Pay tiers are Reserve Tier I, Reserve Tier II, and Reserve Tier II-Plus. Got it? Here’s how they work.

Amazon Pay Payouts – Reserve Tier I

When a merchant registers for Amazon Pay, Amazon sets the account to hold 100% of all funds received from Amazon customers for seven days.

After this waiting period, Amazon releases the reserved money in two installments over the next five weeks.

This tiered Amazon Pay reserve system is put in place to manage a merchant’s financial liability from Amazon customers.

The first installment is released at the end of the seven-day waiting period. The second disbursement occurs after Amazon verifies that all transactions have cleared and are not subject to chargebacks or A-to-z

Guarantee claims.

Amazon Pay Payouts – Reserve Tier II

Merchants who have processed at least 100 orders through Amazon Pay and meet other requirements are automatically upgraded to Reserve Tier II.

The Reserve Tier II amount is either the total amount of any unresolved transaction disputes (chargebacks and Amazon Pay A-to-z Guarantee claims) or three percent of your daily processed payments averaged over the past 28 days, whichever is greater.

Amazon Pay places this reserve to help protect sellers from financial losses that could occur if a large number of chargebacks or A-to-z Guarantee claims are filed.

Once you’re in Reserve Tier II, Amazon releases the funds in two installments over the next five weeks, as described in the Reserve Tier I section.

Amazon Pay Payouts – Reserve Tier II-Plus

If you’re wondering why there’s Tier II and Tier II-Plus instead of Tier III, let’s explain that now. It might seem odd, but there’s actually a great reason.

When you reach the requirements of a Tier II merchant, Amazon will automatically place your business into Tier II-Plus if you meet specific criteria.

If Amazon Pay determines that your ODR (Order Defect Rate) is below one percent averaged over the preceding 60 days, you’re automatically upgraded to Reserve Tier II-Plus.

Now that you understand Reserve Tier basics let’s move on to the next section, which explains another factor influencing Amazon Pay payments—payment transfers.

What Are Amazon Pay Payment Transfers & How They Affect Payments

With the tiers in mind, let’s discuss when (and how much) Amazon pays you every two weeks. Several factors determine how quickly and how much you receive once your reserve clears.

There’s your current Amazon Pay tier and how quickly your ACH payment clears. ACH clearance usually occurs in 3 to 5 days. The settlement process takes the longest to wait for, which depends on your settlement tier.

But generally, it will take around 17 – 19 days for you to receive an Amazon Pay payment.

How the Amazon Pay tiers work to influence payments is simple.

Amazon Pay Payment Times By Tier

Tier I: You’re a new Amazon Pay merchant, and Amazon reserves 100% of the past seven days of payments. Settlements occur every two weeks.

Tier II: You’re an Amazon Pay merchant for 365 days and have 100 completed orders. Amazon sets a reserve one of two ways. Your reserve price depends on the higher amount of these two metrics:

- The total amount of any unresolved transaction disputes.

- Three percent of your daily processed payments averaged over 28 days.

The cool thing about Tier II is that you can technically upgrade earlier if you meet specifications. Typically, it takes a year of using Amazon Pay before you can apply for an upgrade to Reserve Tier Two after only six months of selling.

If you complete 100 orders and have a defect rate of less than 1%, Amazon will review your Tier II Reserve upgrade.

Tier II-Plus: You’re an Amazon Pay merchant for 365 days, and your ODR is below one percent averaged over the preceding 60 days. You automatically receive Reserve Tier II-Plus if you meet the tier qualifications.

Aiming for Tier II-Plus is essential because settlement tiers are one of the factors that determine your payout schedule and daily sales volume.

It’s best to aim for Tier II as quickly as possible since you can get larger payments every two weeks than Tier I sellers.

Your Next Steps As An Amazon Pay Payouts Merchant

Are you searching for a way to accept online payments on your eCommerce shop? Amazon Pay may be a great solution for you.

Amazon Pay makes it simple for your customers to pay for your brand’s goods and services. However, Amazon Pay payouts seem to be a common issue for new merchants that aren’t familiar with Amazon’s payment terms.

However, Amazon Pay payouts are here to protect consumers and Amazon sellers. With Reserve Tiers, your business can grow with the safety net of protection against financial losses, but it can be difficult to wait 17 days to receive Amazon Pay payouts.

If you’re looking to grow your brand this year, consider working with an Amazon marketing Agency that knows how to build and grow Amazon sales channels. We’d love to help your brand develop a strategy for selling via Amazon.